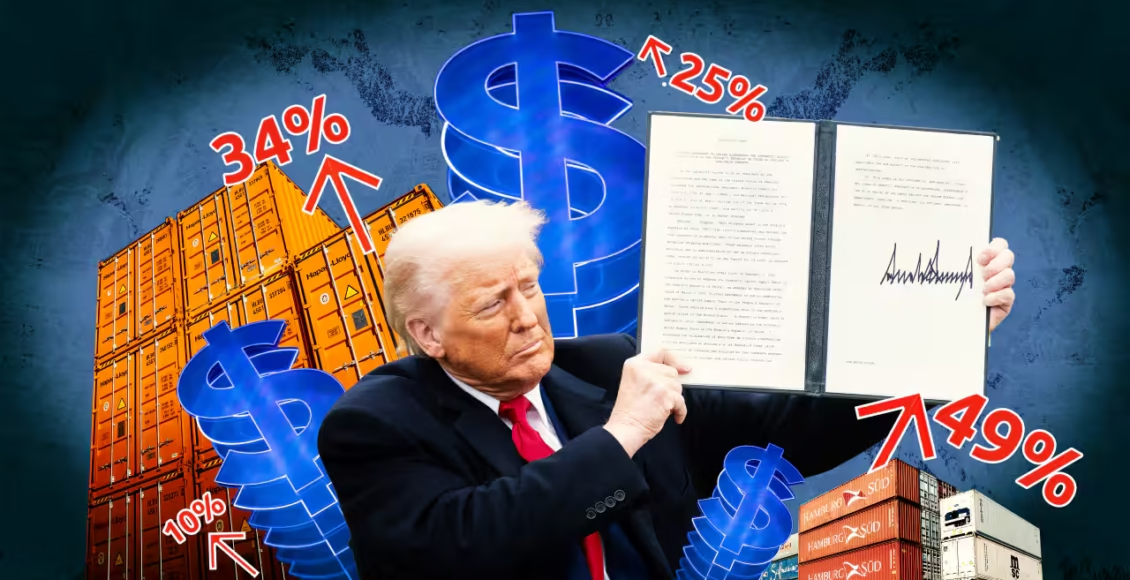

Donald Trump, the president of the United States, recently declared increased taxes on items imported from Pakistan and other nations. This move has generated a lot of debate worldwide. While some view it as a foolish decision, others believe it marks the beginning of a new trade war with potentially hazardous repercussions. However, let’s first examine what tariffs are and their purpose before delving into how Trump’s tariffs would impact Pakistan.

A tariff is a levy imposed by a government on products and services that are imported from other nations. This tax is paid to the government by the company importing the goods when they enter the nation. “Ad Valorem” tariffs are often determined as a proportion of the item’s worth.

Tariffs are primarily used to safeguard domestic businesses by raising the cost of imported goods. This protects domestic companies from international competition by encouraging consumers to purchase locally made goods. Governments can also make money from tariffs, particularly in nations with few alternative revenue options. Additionally, by encouraging exports and discouraging imports, they can aid in lowering trade deficits.

The dealers who bring foreign goods into the nation, known as importers, are liable for paying the duty at the time of entry. But typically, the expense is transferred to the customers, who wind up paying more for imported goods. Customers are typically the ones who suffer the most from these price increases, while occasionally companies may absorb a portion of the additional expense in order to stay competitive.

Let’s now examine the rationale behind Trump’s tariffs. The president of the United States wants to make the American economy stronger. Given that numerous nations likewise put tariffs on American goods, his actions could be advantageous to the United States economically. Thus, what appeared to be a one-sided conflict has become a two-sided trade war under Trump. But as a result, developing nations like Pakistan can encounter serious difficulties.

Pakistan is one of the 185 nations impacted by Trump’s new tariffs. Given that Pakistan imposes 58% taxes on U.S. imports, the country has been struck with a 29% retaliatory duty. Many have referred to this action as the start of a trade war. China, another significant trading partner, has likened it to extortion, even though China imposes 67% tariffs on American imports as well.

Let’s first examine the two nations’ trade relations in order to comprehend how these tariffs will impact Pakistan. Pakistan exports surgical tools, rice, and textiles to the United States. American consumers would now have to pay more for these Pakistani items due to the additional tariffs, which may hurt Pakistani exporters.

Pakistan currently exports more goods to the United States than it imports, resulting in a trade surplus. But these increased tariffs may cause fewer money to enter Pakistan, which could result in employment losses there.

Surprisingly, the Pakistani stock market has not changed much in spite of the impending trade war. According to experts, there may be an opportunity to negotiate a tariff resolution through conversation because the United States has made space for bilateral discussions.

According to experts, Pakistan should watch how other nations—such as China, India, and European countries—react to the taxes. Pakistan has the chance to negotiate with the United States and attempt to strike a balance between the 29% tariffs the United States has set and the 58% tariffs it now charges.

According to some analysts, Pakistan’s total commerce with the United States is only around $7 billion. Consequently, Pakistan’s exports may suffer from this levy even if the United States is not a significant trading partner.

Textiles are the industry most likely to be impacted by these levies since Pakistani exporters will need to change their prices to remain competitive. Additionally, this latest tariff increase hampers Pakistan’s efforts to reach a Free Trade Agreement (FTA) with the United States.

Furthermore, if this trade war intensifies, it may have an impact on Pakistan’s Generalized System of Preferences (GSP) Plus status, which permits duty-free exports to Europe. The impact on Pakistan’s exports would be severe.

What steps may Pakistan take to control this situation, then? According to experts, Pakistan must raise its human rights standards in order to keep its GSP Plus status with Europe, which will support zero-tax exports to European markets. In order to be competitive in the global market despite the higher tariffs, Pakistan must also concentrate on increasing trade with the Middle East and improving the quality of its products.

Pakistan must also focus on value addition to increase the appeal of its goods to buyers throughout the world. This can guarantee that Pakistan’s exports are not negatively impacted by increasing tariffs.

Finally, citizens frequently suffer the most as a result of nations’ involvement in tariff wars. In Pakistan’s situation, the tariffs imposed by the United States will raise the cost of its goods on the American market, resulting in inflation. However, the decreased demand for their products will damage Pakistani exporters. Retaliatory tariffs from Pakistan could result in even greater expenses for the general populace and additional financial hardship.

To prevent the negative consequences of this trade war, the Pakistani government must thus make every effort to maintain its GSP Plus status, investigate new markets, and raise its export standards. Pakistan may see much greater unemployment and inflation if it does not take immediate action.